Why SaaS Sales Models Break TPM and Managed Services Growth

12 January 2026 - 5 Minute Read

When Process Replaces Judgement and Growth Quietly Dies

There is a growing habit in IT services organisations, particularly MSPs and third‑party maintenance (TPM) businesses, to adopt sales models designed for SaaS companies.

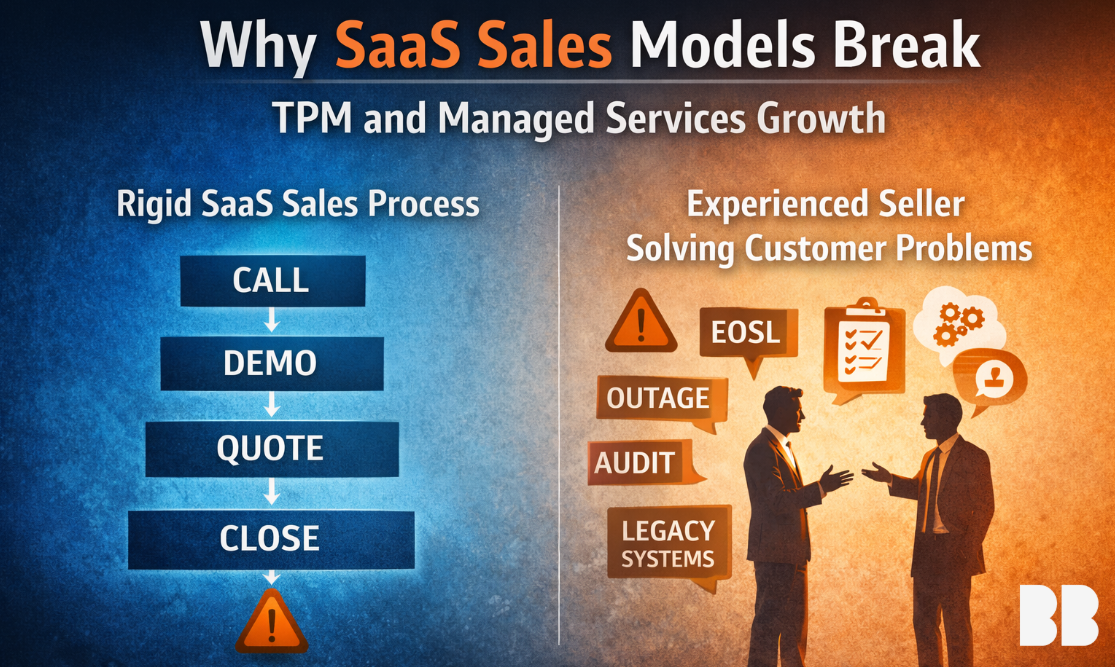

On the surface, the logic is compelling. Sales activity is mapped into a neat, linear journey:

- Calls → meetings → demos → proposals → close

- Every step tracked

- Every seller measured

- Dashboards full of ‘insight’

These models are often introduced under pressure, when growth slows, forecasts slip, or private equity patience wears thin. When presented by a consultancy or mandated by an investor, they feel not just reasonable, but modern.

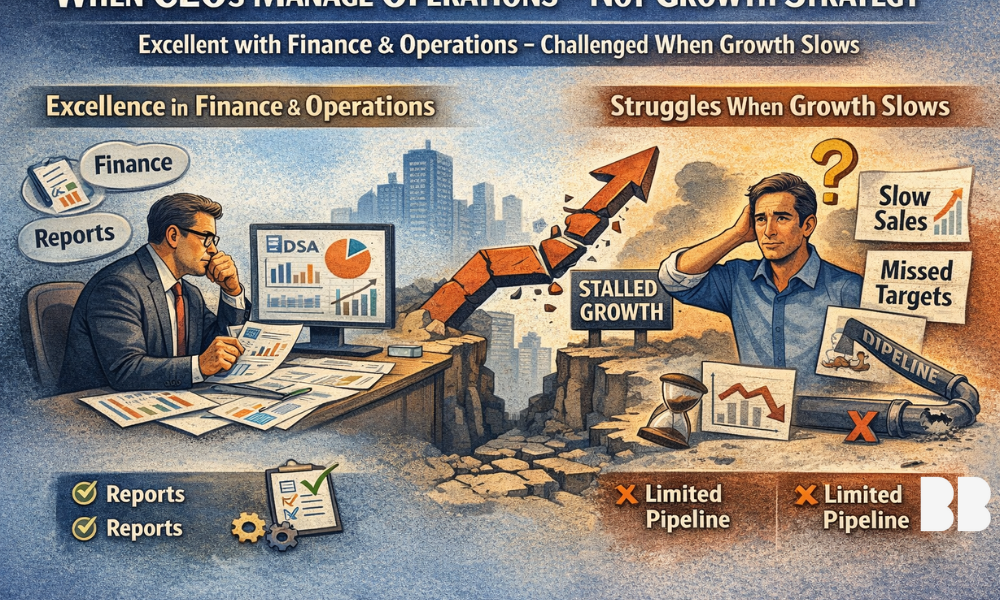

For CEOs without deep sales or delivery experience, accepting this advice is entirely rational.

Unfortunately, in TPM and managed services, it is also deeply flawed.

SaaS Logic Assumes a Customer Journey That Doesn’t Exist

SaaS sales models work because they assume:

- A standardised product

- A predictable buying journey

- Clear customer-side ownership

- Low switching friction

- Limited operational dependency post-sale

None of this holds true in TPM or managed services.

Here, the customer journey is non-linear, driven by outages, audits, EOSL events, commercial inflection points, and internal politics. It depends heavily on credibility, technical judgement, and trust.

Trying to force this complexity through a linear activity funnel doesn’t simplify selling, it distorts it.

When Growth Slows, Organisations Double Down on the Wrong Thing

Rather than questioning whether the go-to-market model still fits the problem being solved, leadership responds to slow growth by tightening control:

- More prescribed sales stages

- Higher mandatory activity volumes

- Additional tools and analytics

- Stricter CRM compliance

The logic is internally consistent: if results are poor, sellers must not be following the process closely enough.

So when performance doesn’t improve, the conclusion becomes inevitable:

“Sales isn’t adapting.”

Activity Replaces Customer Understanding

At this point, selling shifts away from understanding:

- What problem the customer is trying to solve

- Why they would change supplier

- Why now, and why you

And towards monitoring:

- Call volumes

- Demo counts

- Stage compliance

The process becomes the goal and the customer becomes secondary.

How Organisations Lose the Sellers They can Least Afford to Lose

This is where real damage occurs.

Experienced TPM and managed services sellers rarely sell in straight lines. They work long, messy, relationship-led cycles and focus on fewer, higher-value opportunities.

They may not hit arbitrary activity targets but they do create revenue.

Measured against SaaS-style metrics, they suddenly look like underperformers. They are coached, pressured, performance-managed or leave.

Ironically, these are the very people capable of turning results around.

“You Don’t Need Expensive Salespeople Anymore” is the Most Dangerous Advice of All

Almost inevitably, leadership is told:

“With the right process, you don’t need highly paid, experienced sellers. You can hire young, hungry talent to follow the model.”

For a CEO who has never had to sell themselves, this sounds sensible.

In reality, it misunderstands the sale entirely.

TPM and managed services sales are not transactional execution problems. They are trust decisions, risk-transfer decisions, political decisions, and technical credibility decisions.

Replacing judgement with volume does not solve these problems. It accelerates decline.

The Doom Spiral

The end result is depressingly consistent:

- Revenue continues to fall

- Sales turnover increases

- Delivery distrusts sales

- The process is tightened again

- Morale collapses

At this point, the organisation believes it has a people problem.

In reality, it has a model problem.

Feature-led Selling Doesn’t Solve Customer Problems

Another structural flaw in SaaS-derived models is what they train sellers to talk about.

Because the process is built around product velocity, conversations move from feature to feature rather than from problem to consequence to resolution.

What’s missing is any obligation to deeply understand the customer’s operational or commercial problem, quantify the cost of doing nothing, or align the solution to the customer’s constraints and politics.

In TPM and managed services, customers are not buying features. They are buying reduced risk, commercial certainty, continuity through change, and someone willing to take responsibility for complexity they no longer want to own.

A process that progresses buyers through product talking points may look productive in CRM, but it does nothing to move real buying intent forward.

The Uncomfortable Truth

SaaS sales models are not wrong.

They are simply wrong here.

TPM and managed services businesses do not win by industrialising activity. They win by understanding where risk and pain sit in the customer estate, aligning commercial offers to those moments, and empowering experienced sellers with judgement, not drowning them in tools.

Process should support selling, not replace it.

Bringing the Focus Back to Sales Basics

The answer is not less structure, but better judgement about what structure is for.

High-performing TPM and managed services sales organisations focus relentlessly on:

- Understanding the customer’s real problems

- Being clear about which problems they are uniquely qualified to solve

- Concentrating effort on activities that genuinely advance those outcomes

That means fewer dashboards, fewer vanity metrics, and far more emphasis on quality conversations, commercial curiosity, technical credibility, and experience-led judgement.

At Baby Blue IT Consulting, this is our focus: helping IT services businesses step back from inherited sales models that don’t fit, refocus on real customer problems, and rebuild sales activity around what actually drives results.

This pattern is increasingly visible in PE-backed IT services businesses, particularly during periods of change or growth pressure. Recognising it early gives investors and leadership teams the opportunity to bring in additional commercial perspective, strengthen decision-making, and correct course before value erosion sets in.

About the Author

Chris Smith

Chris Smith is a sales leader and consultant with over 30 years of experience in IT managed services. With a background in IBM hardware maintenance, he transitioned from field engineer to sales and marketing director, creating the foundations for Blue Chip Cloud, which became the largest IBM Power Cloud globally at the time. Chris played a key role in the 2021 sale of Blue Chip and grew managed services revenue by 50%. He’s passionate about building customer relationships and has implemented Gap Selling by Keenan to drive sales performance. Now, Chris helps managed service providers and third-party maintenance businesses with growth planning and operational improvement.

LinkedIn