When CEOs Haven’t Had to Grow the Business

12 January 2026 - 6 Minute Read

Why Capable Leaders Still Need External Perspective When Growth Stalls

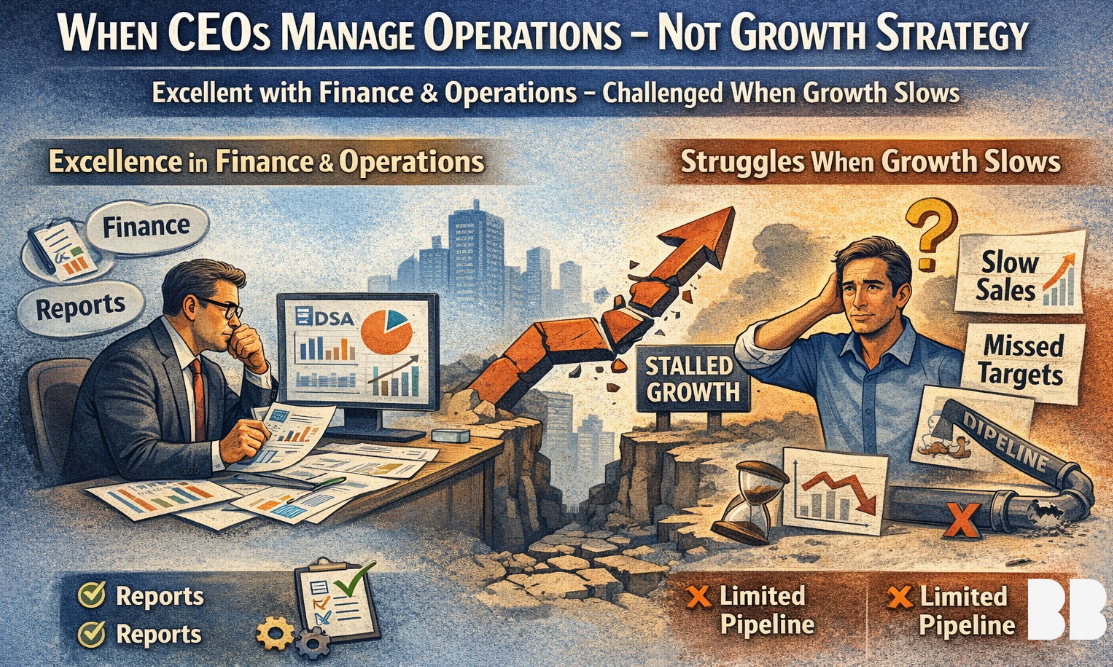

In the IT services world, particularly across MSPs and third‑party maintenance (TPM) businesses, it’s increasingly common to see CEOs who have come up through finance, operations, or technical disciplines rather than sales or delivery leadership. Inherently, there is nothing wrong with this. In many cases, these individuals are highly capable, disciplined, and exactly what the business needed at a particular stage of its evolution.

However, when growth slows, acquisitions underperform, or private equity expectations start to bite, this background can quietly become a constraint. Not because the CEO is “wrong”, but because they’ve never been required to personally create and drive growth strategy under pressure.

This distinction matters far more than most boards are comfortable admitting.

A Scenario Most Readers Will Recognise

A PE‑backed MSP appoints a CEO from a strong CFO or COO background post‑acquisition.

On paper, it makes perfect sense. Margins need protecting. Governance needs tightening. Reporting needs to stand up to investor scrutiny. The new CEO is smart, credible, and trusted by the board.

Year one reassures the board.

Revenue is flat, but EBITDA is stable. Forecast accuracy improves. Dashboards are clean.

Year two exposes the fragility.

- New logo acquisition slows

- Pipeline still “meets target”, but deal quality deteriorates

- Average deal size shrinks

- Sales cycles lengthen

- Delivery becomes more defensive

The response is logical, at least on the surface:

- More pipeline stages

- Tighter CRM compliance

- More frequent forecast calls

- Sales compensation nudged towards activity rather than value

From the CEO’s perspective, this is sensible control. From the frontline’s perspective, growth has just become harder.

What’s missing isn’t intelligence or effort, it’s lived growth experience.

The CEO has never personally rebuilt a failing go‑to‑market model, carried a revenue number through a market shift, or chosen between short‑term EBITDA protection and long‑term revenue quality.

So the organisation optimises process instead of judgement.

By the time the board intervenes, the narrative has already shifted from:

“We need to grow”

to

“The market is tough”

External commercial support is brought in, not because the CEO has failed, but because the business has outgrown the CEO’s experience base, not their capability.

Operational Excellence is not the Same as Growth Leadership

Many CEOs who rise through finance, operations, or account management are excellent at cost control, governance, reporting, and risk management. These capabilities are critical - especially post‑acquisition.

But they are not the same skills required to:

- Design a credible growth narrative

- Translate strategy into frontline sales and delivery behaviour

- Align incentives with value creation rather than activity

- Decide where not to grow, and enforce it

For many such CEOs, growth has always been someone else’s job. Sales owned revenue. Delivery owned retention. Marketing owned pipeline. The CEO optimised the system around them.

In PE‑backed environments, particularly buy‑and‑build strategies, that separation collapses. Growth becomes the CEO’s primary accountability. When it falters, there is nowhere to hide.

This is not a criticism, it’s a reality gap.

Why Things Unravel When the Plan Meets Reality

From our work with PE‑backed IT services businesses, a familiar pattern emerges:

- A strategy deck is produced. Often externally supported and logically sound

- KPIs and targets are defined. Usually activity‑based rather than outcome‑based

- The organisation is told to “execute”. Without meaningful change to behaviour or incentives

- Results disappoint. Pipeline quality degrades and delivery friction increases

At this point, the instinctive response is more control: more reporting, more dashboards, more process. But this is precisely the wrong reflex when growth is the problem.

As we explored previously in The Gaming of Sales KPIs, dashboards without commercial discipline simply encourage optimisation around the numbers, not the outcome.

The SaaS Sales Trap Well‑Intentioned CEOs Walk Into

A common accelerant at this stage, particularly under private equity pressure, is the introduction of a modernised sales model, often borrowed wholesale from SaaS businesses.

It arrives well‑packaged, data‑rich, and presented as best practice.

Activity is mapped into a prescribed journey:

- Calls → meetings → demos → proposals → close

- Every step tracked

- Every seller measured on adherence

When growth slows, the logic feels sound: tighten the process, increase activity, improve visibility.

For a CEO without lived sales or delivery experience, accepting this advice is entirely rational.

The problem is that TPM and managed services sales do not work this way.

Customers are not moving linearly through product features. They are responding to risk events, legacy estates, EOSL pressure, audits, outages, commercial inflection points, and internal politics. Trust and judgement matter far more than activity volume.

SaaS‑derived models quietly shift selling away from solving customer problems and towards progressing internal stages. Features replace outcomes. Activity replaces understanding.

When results don’t improve, the narrative rarely questions the model itself. Instead:

“Sales isn’t adopting the process.”

This is where experienced, high‑value sellers are often lost, not because they can’t sell, but because they don’t conform to arbitrary activity metrics despite creating real revenue.

The outcome is predictable: continued decline, rising attrition, and leadership doubling down on control rather than judgement.

Read more about the SaaS trap here: Why SaaS Sales Models Break TPM and Managed Services Growth

Why External NED or Fractional Support Changes the Outcome

Experienced Non‑Executive Directors or fractional commercial leaders bring something fundamentally different:

- Pattern recognition from multiple growth cycles

- Independence from internal politics

- Credibility with sales, delivery, and PE stakeholders

- The confidence to challenge both the CEO and the investment thesis

Crucially, they help reframe the problem from “execution failure” to “strategy and incentive misalignment”.

This is particularly important in MSP and TPM businesses, where revenue quality matters more than top‑line growth, legacy contracts distort margin signals, and OEM, TPM, and cloud strategies collide operationally.

As discussed in From Owner‑Led to Board‑Led, the next level of growth often starts in the boardroom, not the sales floor.

Final thought

CEOs without sales or delivery backgrounds can absolutely lead successful IT services businesses. Many do.

But when growth becomes the central challenge, particularly under PE ownership, experience matters. Not theoretical knowledge, but lived, uncomfortable, number‑carrying experience.

Recognising that early and surrounding yourself with the right external perspective is not a concession, it’s a growth strategy in its own right.

If this resonates, explore our related posts on leadership, board evolution, and value creation in IT services on the Baby Blue IT & Consulting blog or book a meeting.

About the Author

Chris Smith

Chris Smith is a sales leader and consultant with over 30 years of experience in IT managed services. With a background in IBM hardware maintenance, he transitioned from field engineer to sales and marketing director, creating the foundations for Blue Chip Cloud, which became the largest IBM Power Cloud globally at the time. Chris played a key role in the 2021 sale of Blue Chip and grew managed services revenue by 50%. He’s passionate about building customer relationships and has implemented Gap Selling by Keenan to drive sales performance. Now, Chris helps managed service providers and third-party maintenance businesses with growth planning and operational improvement.

LinkedIn