You’ve Just Bought a Lemon: What Private Equity Should Do When an IT Acquisition Unravels

6 December 2025 - 4 Minute Read

Private equity firms today are under enormous pressure to deploy dry powder. Valuations have been high, competition for technology assets intense, and the race to own “the next great IT or software platform” has never been more aggressive.

On paper, many of these companies look fantastic. Growing revenues, expanding margins, recurring revenue models, and upbeat management teams selling the story of unlimited upside.

But every so often, a deal closes…The champagne goes flat…And it becomes painfully clear the firm has just bought a lemon.

This moment can be career-defining for PE partners. Few things strike fear faster than discovering the growth engine you paid a premium for wasn’t quite what it seemed.

So why does this happen and what can you do about it?

Why IT Deals Look Great on Paper… Until They Don’t

The IT and software sector has been a magnet for private equity for over a decade. It’s easy to see why:

- Sticky recurring revenues

- Mission-critical technology

- High margins

- Strong exit multiples

But beneath the glossy CIMs and growth curves, reality often tells a different story.

1. The Growth Story Doesn’t Match Today’s Market

Tech markets shift rapidly. A business that grew 15–20% annually for the last five years may suddenly find its addressable market saturated, commoditised, disrupted by hyperscalers, or replaced by a simpler modern alternative.

2. The Founder or Entrepreneur Leaves & So Does the Magic

The moment a founder exits, the cultural spark often goes with them:

- Creativity drops

- Agility slows

- Decision-making becomes corporate

- People stop taking risks

Entrepreneurial businesses rarely thrive when the entrepreneurial DNA walks out of the door.

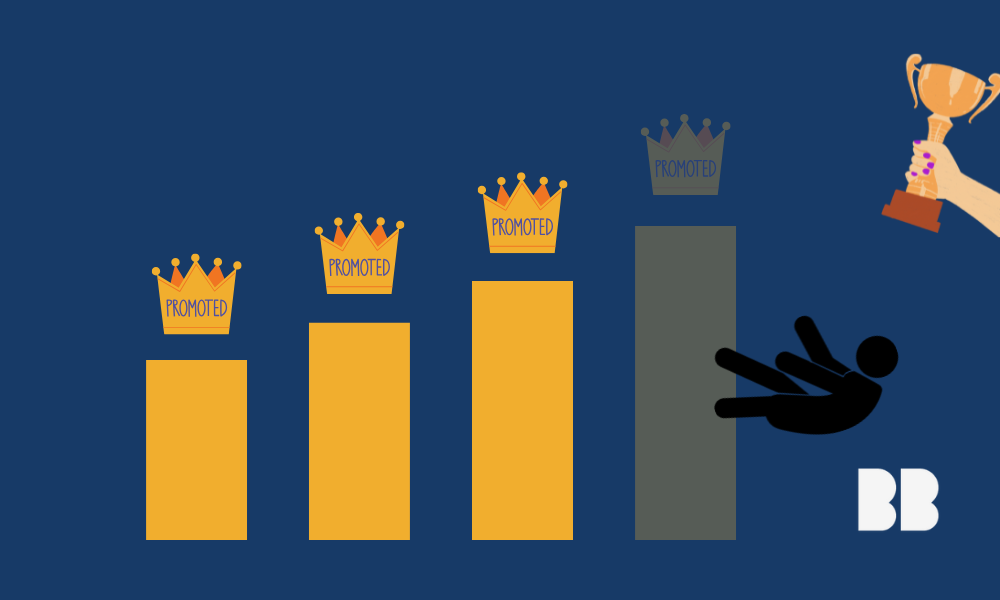

3. PE Brings in a “Big Company Leader” Who Has Never Scaled From Zero to One

This is one of the most common failure points.

PE often hires a heavyweight executive from a large enterprise. Someone polished, presentable, and familiar with scale. But running a £500m division and scaling a £50m business to £150m are entirely different skill sets.

A big-company leader inherits something already built.

A scale-up leader builds it.

The mistake?

Replacing entrepreneurial instinct with corporate process too early.

4. The Strategy Isn’t Wrong, It’s Just Not Executable

A beautifully documented 100-day plan is worthless without operational leaders who have actually lived the journey.

You need people who have:

- Built sales engines from scratch

- Rebuilt service delivery

- Replatformed ageing product lines

- Turned around cultural decline

- Grown through acquisition and integration

Without this, the strategy stays in the boardroom.

Why Harvard Business School Teaches Strategy and Execution

One of the most repeated lessons from Harvard is simple:

“Great strategy without great execution is hallucination.”

And the reverse is equally true:

“Great execution with the wrong strategy is wasted effort.”

To scale a technology business, particularly one that has stalled, you must get both right:

- A strategy grounded in market reality, not historical performance

- A leadership team who can translate strategy into day-to-day behaviour

- Stakeholders who understand the ‘why’, not just the ‘what’

- A communication plan that aligns sales, marketing, delivery, and back-office teams behind one vision

When employees understand where the company is going, why it matters, and what role they play, the organisation starts moving as one.

Without this alignment, even the best PE-backed business can spiral.

So… What Should Private Equity Do If They’ve Bought a Lemon?

Here’s the hard truth:

Very few businesses are actual lemons.

Most simply lack the right leadership, the right strategy, or the right execution capability.

The solution usually involves four steps:

1. Re-diagnose the business with a fresh lens

Not a boardroom audit. A ground-level operational assessment led by people who’ve grown similar businesses before.

2. Rebuild the strategy around today’s market

Forget the CIM. Forget the old business plan.

What does the market need now and next year?

3. Put in leaders who have done the journey, not just talked about it

Not the biggest CV.

Not the most corporate-looking.

But the most battle-tested.

People who know how to take something small and make it big.

4. Restore entrepreneurial culture

You cannot scale an IT services or software business without:

- Speed

- Agility

- Innovation

- Accountability

These traits vanish quickly under the wrong leadership. They can also be rebuilt with the right people.

The Real Question for Private Equity

You can’t undo the acquisition.

But you can change its trajectory.

So the real question is:

If you’ve bought a lemon, what will you do to turn it into lemonade and who will you bring in to make it happen?

Because the truth is, with the right combination of strategy, operational experience, and entrepreneurial leadership, even the most challenging IT acquisition can be transformed into one of your most successful exits.

About the Author

Lee Bailey

Lee Bailey brings 30 years of experience in the IBM services industry, beginning his career in engineering before transitioning into sales and ultimately sales leadership. A qualified Chartered Director (CDir), Lee has served as a Board Member, Director, and Board Advisor for multiple IT services businesses. As the founder of Baby Blue IT & Consulting, he is assembling a team of industry experts focused on IT services and business growth, leveraging his extensive expertise to drive innovation and value for clients.

LinkedIn